The UK is home to some exceptionally generous philanthropists, as a glance at the Sunday Times Giving List quickly confirms. But behind the headlines, what does everyday giving look like among the country’s top earners?

When we last examined the behaviour of this group, we found that the UK’s top 1% of earners in 2018 were typically donating £48 a month to charity, a little below 0.2% of their gross income. We also found that while the average income in the top 1% of earners in the UK grew by 10% between 2011-12 and 2018-19, the typical donations by these earners fell by around 20% over the same period.

Since that report, new data has become available. We are now able to review what happened to charitable giving by this group when the country – and many charities – were thrown into crisis by the Covid pandemic.

The pandemic created a dual crisis for many charities: growing demand and falling income

With the end of in-person fundraising events, combined with widespread fear about income and job security, many charities saw a fall in their public donations during the lockdown period. Between 2020 and 2022, the number of people across the country donating to charity continued a long-term trend of decline. Fewer people were giving and the pandemic led to a decline in the overall value of donations from the public: overall giving from the public fell from £30.5bn in 2017/18 to £26.2bn in 2021/22. At the same time, many charities found themselves managing growing demand for their support and services, as a result of the pandemic and associated lockdowns and social restrictions.

Some donors stepped up. The average size of individual gifts rose during the pandemic, driven by a smaller pool of donors giving more, recognising the urgent need. But how did the UK’s highest earners respond?

In 2021-22, around 2 in 5 of the top 1% of earners in UK earners (those earning a minimum of around £199,000) made charitable donation which they declared in their tax return to claim the Gift Aid rebate*. This is a small (2 percentage point) increase in the number declaring donations on their tax return in 2017-18. That is not to conclude the remaining three in five top earners gave nothing to charity, but just that they did not declare donations on their tax return.

The rest of this analysis focuses only on the giving behaviour of those who declared charitable donations. That is, donations from cash income where a Gift Aid ‘rebate’ claim is made. We take this approach out of necessity because the giving data we can access is declared in self-assessment tax returns and then reported in HMRC’s Survey of Personal Incomes dataset.

During the period of the Covid restrictions (2020-22), most donors among the UK’s top earners continued to make relatively small charitable donations – around 0.2% of their gross income

Among those top earners who gave to charity between 2020 and 2022, most gave relatively small sums as a proportion of their income.

The mean average donation across all donors in the top 1% group in 2021-22 was £4,850 a year, or around £400 a month. But this simple average figure is driven up by a smaller number of especially generous donors whose contribution far exceed donations made by their peers. By looking at the median – that is, the middle value when all donations are lined up from smallest to largest – we can see that the middle average donation in this same group was much lower at £623 a year, or £52 a month.

This median donation was equal to around 0.2% of income, which gives us a good idea of what a typical donor gives.

In contrast, the mean donation – the average of all donations, including a few very large ones – was around nine times higher, at 1.8%. This indicates that a smaller group of very generous donors are pushing up the average, even though most people gave much less.

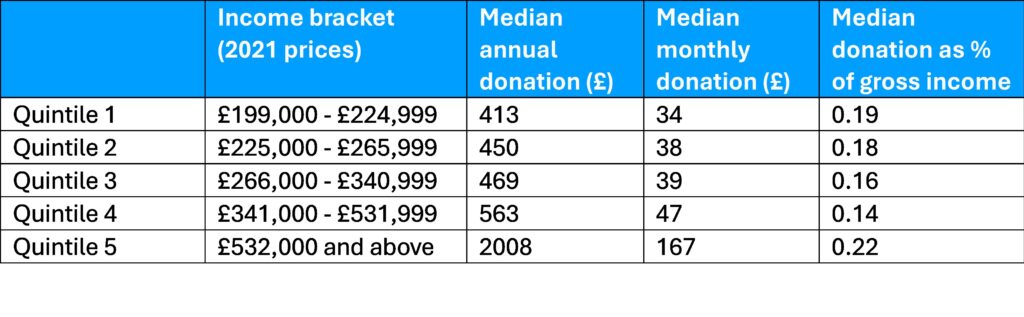

We can further explore the giving habits among the top 1% of earners by dividing them into five income groups. This helps us understand what typical donors at different income levels tend to give.

Typical donors among the very highest earners did grow their giving during the lockdown years, but they started from a low base

The typical donor in the top 1% of earners gave around 0.15% to 0.2% of their income to charity each year, across all quintiles, in 2021-22.

As set out in Table 1 below, this is equivalent to a cash donation of around £34 a month for donors with annual incomes of around £211,000. Donations rose slightly to £39 a month for those in the middle group – people with incomes around £297,000. The biggest typical donations came from the highest earners: people with incomes over £523,000 typically gave £167 a month to good causes.

For context, across the whole UK population, typical people who donated to charity in 2022 gave around £20 a month.

Table 1: Median donations in 2021-22 among the top 1% of earners who declare charitable

Source: PBE analysis of Survey of Personal Incomes data 2021-22 (accessed June 2025)

When we look at changes to charitable donations of typical donors during the period of the Covid restrictions 2020-22, the difference between the very highest earners and the rest of the top 1% becomes more pronounced.

The chart above shows median donation as a percentage of gross income for each quintile of the top 1% of earners in 2017-19 (which we treat as our pre-lockdown baseline), 2020-21 and 2021-22.

For quintiles 1 to 4 median donation as a proportion of income remained similar over this period or dropped slightly. However, among the top 0.2% of earners, median donation rose as proportion of income, from 0.15% in 2017-19 to 0.22% in 2021-22. This illustrates that typical donors in this group did increase their giving during the lockdown years, though they also started from the lowest point, giving less than any other quintile as a proportion of income in 2017-19.

The pandemic did not spark an immediate growth in generosity among the UK’s top earners. But there are positive signs that giving among the wealthiest may now be on the up

The pandemic did not spark an immediate shift in charitable giving among most of the UK’s top earners. Typical donors continued to give only a small fraction of their income, leaving the charity sector still heavily reliant on a minority of especially generous individuals.

Yet there are encouraging signs of change. Since 2021, giving among the UK’s wealthiest appears to be rising. Recent data shows that median donations from high-net-worth individuals (those with investable wealth greater than £1 million) surged from £1,040 in 2020 to £5,600 in 2023. This fivefold increase suggests that, when motivated, wealthy donors can and do step up, especially those with the financial security to give at higher levels.

This upward trend reveals a powerful truth: many of the UK’s richest individuals have the capacity—and the opportunity—to give more. With the latest data showing fewer people than ever are giving to charity, their leadership matters more than ever.

If more top earners chose to give, and if those already giving did so more ambitiously, they could help redefine what generosity looks like in the UK. By leading with bold, visible commitment, they can not only support a social sector under strain, but also inspire a cultural shift toward more widespread, meaningful philanthropy.

Notes on methodology

We use data on the charitable donations declared in self-assessment tax returns by the top 1% of earners using the Survey of Personal Incomes (SPI) Public Use Tape (which has been through an anonymisation process). We downrate the gift aid variable to ensure that the gift aid amounts only include donations from individuals’ net income and does not include any additional money the charity receives. SPI is based on information held by HMRC on individuals who could be liable to UK income tax. It is the most comprehensive and accurate official source of data on personal incomes for those earning above PAYE thresholds. The analysis is based on the SPI Public Use Tape which has been through an anonymisation processes.

* Gift Aid works on the principle that you shouldn’t have to pay tax on income you donate to charity. Higher and additional rate taxpayers can claim the difference between their tax rate and the basic rate of income tax paid on a donation, though research suggests that many do not make claim largely due to the administrative costs and lack of understanding of the Gift Aid rebate scheme.

With thanks to Ben Gardiner, Marie Horton and Beth Kitson.